Calculate 401k contribution percentage

Held an approximate 65 trillion in retirement assets according to the Investment Company Institute. How to calculate your SEP IRA contribution If you pay yourself a salary using a IRS W-2 form then calculating your maximum allowed SEP IRA contribution is easy.

401 K Plan What Is A 401 K And How Does It Work

Enter amount in negative value.

. Many employees are not taking full advantage of their employers matching contributions. A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. You should notify the employee that the excess contribution is not eligible for favorable tax-free rollover.

With a 401k match the employer can determine what percentage of employees income to match. Under the After Tax Adjustments section select your state or enter your state income tax rate enter any after-tax deductions health insurance premiums dental plan premiums etc. 57000 in taxable income.

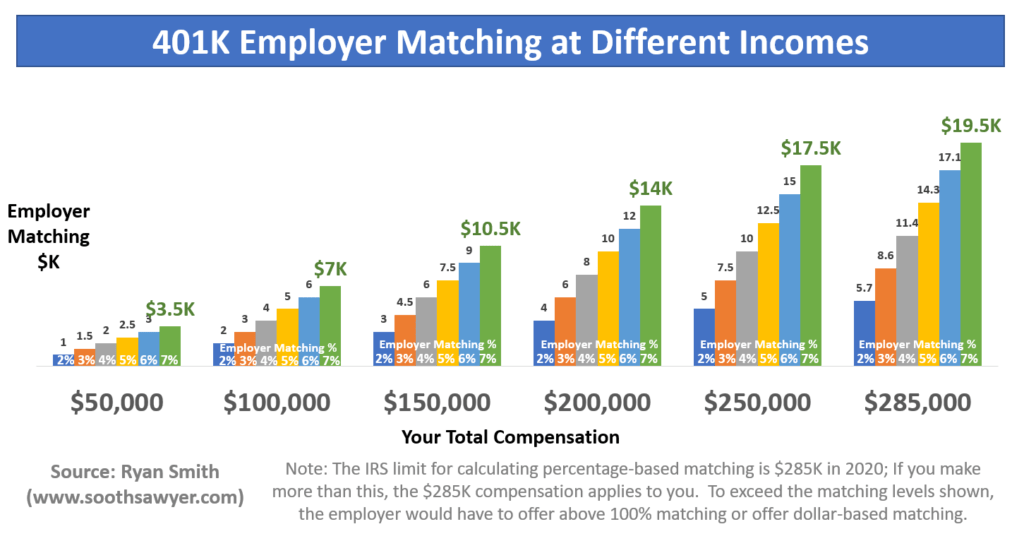

Realized short-term capital gains realized. These contributions must be the same percentage for each participant. If this employee earned 60000 the employer would contribute a maximum of 1800 to the employees 401k that year.

Some employers even offer contribution matching. A profit-sharing plan may include a 401k. The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds Bond Price Field - The Price of the bond is calculated or entered in this field.

Firstly it is to be determined which input costs are indirect by nature for the manufacturing of a product or service deliveryNext add up all these costs together to arrive at the total manufacturing overhead. You can calculator your commission by multiplying the sale amount by the commission percentage. Next calculate all the administrative costs and general costs that cant be directly allocated to the manufacturing of the product or service delivery.

This number is the exact amount you will need but it is recommended that you add an additional 10 because some tiles will need to be cut. 3073 will be your working number to determine how much you should spend on rent each month. The 2023 contribution limits for 401k403b457 plans and TraditionalRoth IRA will go up substantially due to high inflation.

Theyre not restricted by the annual contribution limit. Footnote 1 Any earnings on Roth 401k contributions can generally be withdrawn tax-free if you meet the two requirements for a qualified distribution. The plan contains a formula for allocating to each participant a portion of each annual contribution.

2021-30 Appendix B Section 20. We do not distinguish among workplace retirement plan contribution sources. Only 6 of companies that offer 401ks dont make some sort of employer contribution.

Profit-Sharing Plan is a defined contribution plan under which the plan may provide or the employer may determine annually how much will be contributed to the plan out of profits or otherwise. All sources are considered pre-tax savings. If you take a.

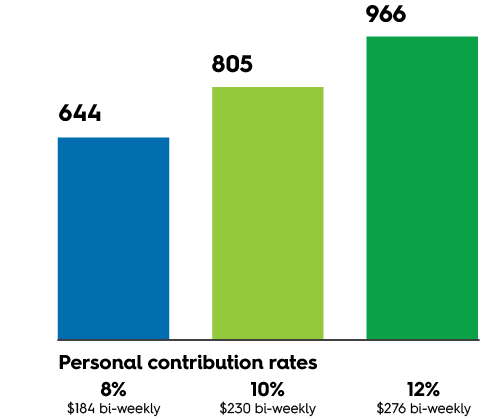

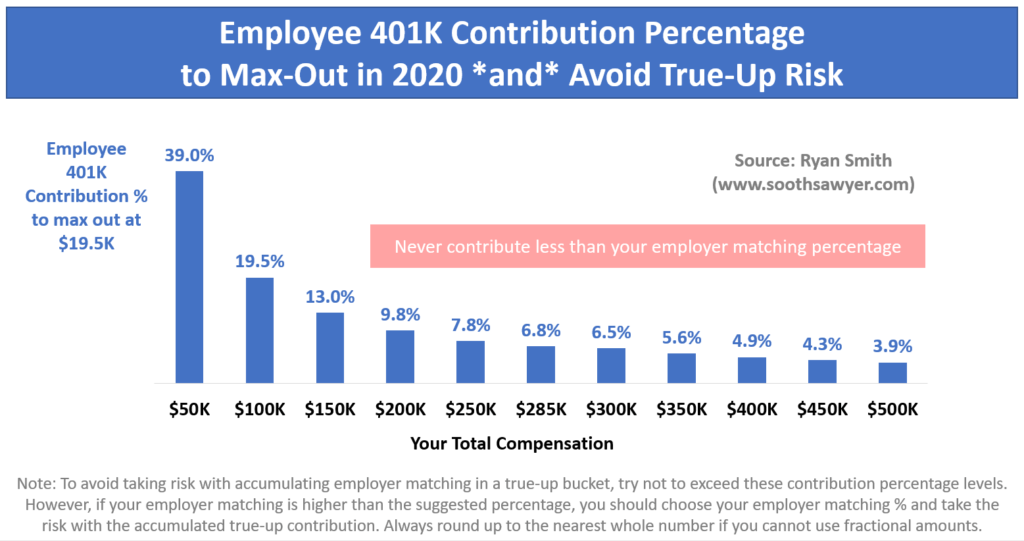

So normally we would be able to calculate. Under the Before Tax Adjustments section enter any qualifying 401k percentage or HSA contribution amounts that are being withheld from your paycheck. Do this quick calculation and keep reading to figure out what percentage of your income should go to.

44446 net income. A self-employed 401k plan is also know as a Solo 401k plan. 3703 monthly or 1851 bi-weekly after-tax income.

An employer-sponsored 401k retirement. If you are paying an advisor a percentage of your assets you are paying 5-10x too much. However its more common for employers to make matching contributions to these accounts.

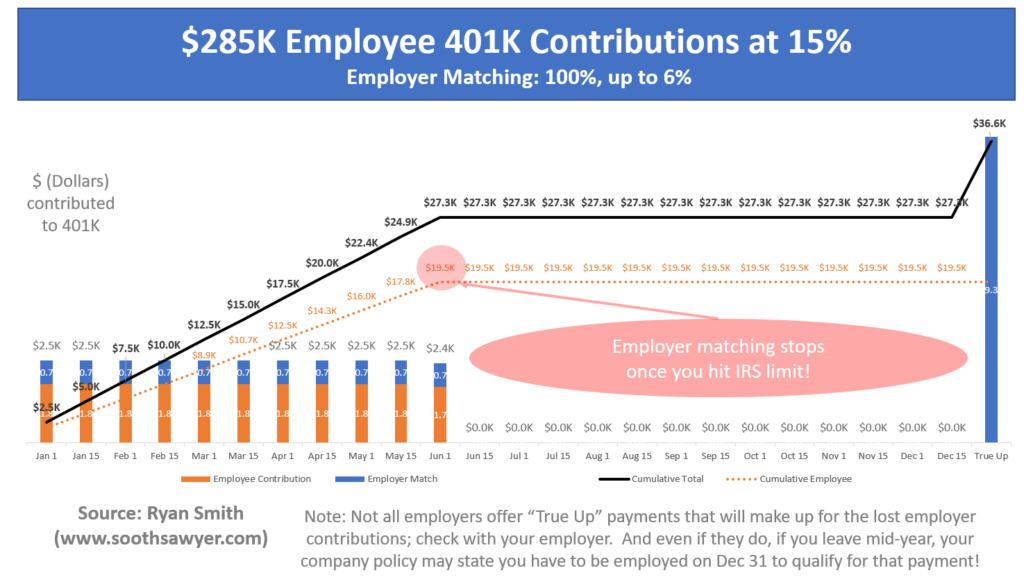

If your employer offers a 401k plan consider contributing pre-tax money with every paycheck. Accordingly the model uses data from the Lipper peer group for each asset class to calculate an assumed percentage of four categories of earnings with different tax impacts. If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000 year 2022 limit for those 50 years or older in the first few months of the year then you have probably maximized your contribution but minimized your employers matching.

The tile calculator lets you know how many tiles you will need based on the size of the tile and the square footage of the area you are tiling. Contribute to your 401k. 3000 for 401k contributions.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. Excess contributions adjusted for earnings are assigned and distributed to the HCEs. Method 2 one-to-one method under Rev.

In other words if you make a sale for 200 and your commission is 3 your commission would be 200 03 6. For 2021 the IRS says you can contribute up to 61000 in your self-employed 401k plan. The Roth 401k contribution limits are cumulative with your traditional 401k contributions and cannot exceed 19000 as of 2019.

There are a number of retirement accounts that allow you to save and invest toward your retirement goals but one of the most common in the US. The annual contribution limits for 401k plans are identical to those allowed for 457b plans. 1 At least five years must have elapsed from the first day of the year of your initial contribution and 2 You must have reached age 59½ or become disabled or deceased.

Learn how to find an independent advisor pay for advice and only the advice. Many sales professionals are paid on commission a method of payment where you receive a percentage of the sales. 22 Tax rate.

As of September 2020 401k plans in the US. For example if youre 55 in 2019 and you contribute 10000 to your traditional 401k you cant contribute more than. Try to meet or exceed their matching amount to make the most of your retirement savings.

This article will discuss how much you can contribute to your self-employed 401k plan. If youre 50 or older you can make an additional catch-up contribution of 6000. Face Value Field - The Face Value or Principal of the bond is calculated or entered in this field.

For example an employer may match up to 3 of an employees contribution to their 401k.

How Much Can I Contribute To My Self Employed 401k Plan

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

After Tax 401 K Contributions Retirement Benefits Fidelity

How Much Should I Have Saved In My 401k By Age

Retirement Services 401 K Calculator

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Free 401k Calculator For Excel Calculate Your 401k Savings

How To Protect Your Retirement Savings Fidelity Investments Investing Investment Portfolio Saving For Retirement

401 K Calculator See What You Ll Have Saved Dqydj

Customizable 401k Calculator And Retirement Analysis Template

401 K Contributions How Much Is Enough Securian Financial

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

What Is A 401 K Match Onplane Financial Advisors

Doing The Math On Your 401 K Match Sep 29 2000

What Percentage Of People Max Out Their 401 K Financial Samurai

Percentage Of Private Sector 401 K Plans With An Employer Match By Download Table